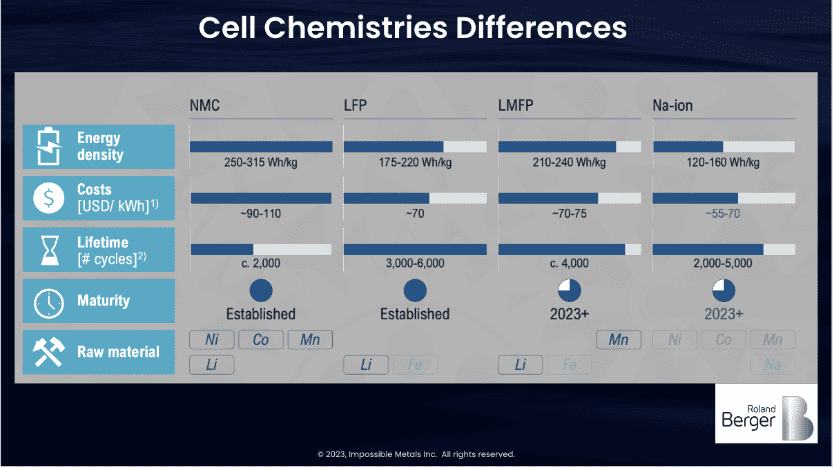

Cathode chemistries dominate the conversation about the batteries that power electric vehicles (EV): LFP and NMC. LFP, short for iron phosphate, relies on ion-based chemistry, while NMC, a combination of nickel, manganese, and cobalt, has historically dominated the EV battery market. Chinese battery manufacturers invested heavily in LFP, which is now growing market share in Europe and North America. This now demands a closer, more practical look at its strengths and limitations.

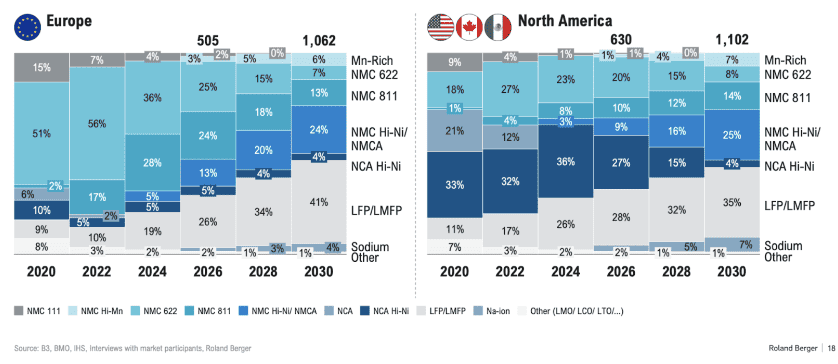

Expected Battery Cell Demand by Cathode Chemistry, [GWh/ a]

Emerging on the horizon are variants like LMFP cathode, an iron phosphate blend infused with manganese for increased energy density, and the innovative sodium-ion, a non-lithium-based chemistry better suited for stationary storage. North American and European automotive manufacturers typically need to see 3+ years of samples from the production manufacturing line. It usually takes 10+ years from lab samples to volume production in a car.

Addressing Perceptions: Myths vs. Realities

Addressing perceptions surrounding LFP and NMC is crucial. Let’s look at the five often-circulated critical perceptions about LFP and the inconvenient truths that are the reality.

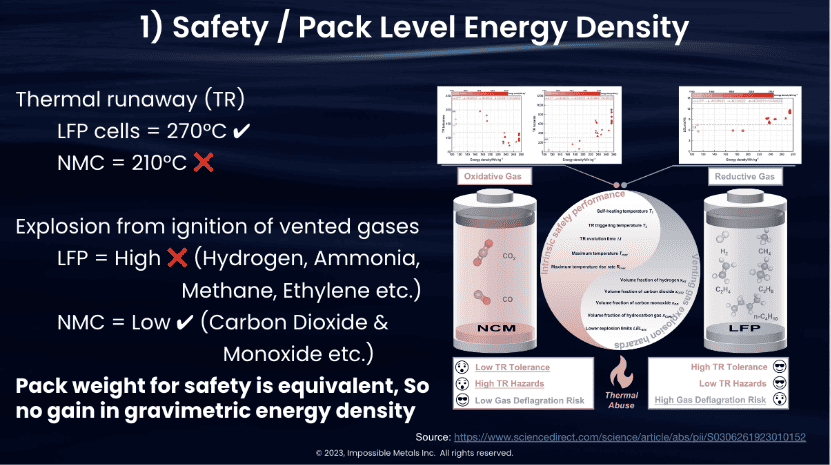

Perception #1: LFP is Much Safer than NMC, so Battery Pack Level Energy Density is Similar

The belief that LFP is inherently safer than NMC due to lower thermal runaway temperature for NMC is correct. The supporters of LFP will then say that at the cell level, the energy density is less than NMC, but because the pack design can be simpler due to better safety, the energy densities are the same at the pack level.

However, it overlooks the explosion risks from vented gases. Recent studies indicate that LFP releases highly combustible gases like hydrogen, ammonia, methane, and others, whereas NMC vents less volatile gases like carbon dioxide and monoxide. These studies highlight the explosion risk from vented gases, which means the pack design for safety will have a similar weight. Hence, the energy density at the pack level will always be significantly higher for NMC, resulting in around 33% more range.

Perception #2: LFP Is Always Much Cheaper Than NMC Because of the Lack of Nickel and Cobalt

Historically, LFP has been touted as a more economical choice, leveraging cheaper iron and phosphorus than the nickel and cobalt alternative of NMC. However, recent data suggests a narrowing cost differential, with factors like recycling value playing a pivotal role. While nickel and cobalt hold significant recycled value, iron and phosphorus lack such value, posing challenges in the recycling process and overall cost-benefit analysis. In fact, if you factor in the lifetime value of LFP cells, you may have a negative cost to recycle them.

The escalating demand and cost for lithium may also impact LFP prices adversely, challenging the notion of perpetual cost advantage.

Because the energy density of NMC is approximately 33% higher than that of LFP, a smaller amount of metal is needed to achieve the same kWh. This reduced metal requirement leads to a smaller battery pack for the equivalent amount of kWh, decreasing the amount of metal required for battery production and saving costs.

Deep sea minerals will have the lowest cost of all nickel and cobalt mines. See here. The low cost of deep sea minerals will allow Impossible Metals to offer significant discounts to our lead customers, again allowing them to use NMC cells at a lower price than LFP.

Perception #3: You Can Receive Inflation Reduction Act (IRA) Subsidies for LFP

The IRA subsidies, aimed at promoting domestic battery production, present hurdles for LFP batteries. China is on the ‘Foreign Entity of Concern’ list, meaning that Chinese companies do not qualify for IRA subsidies.

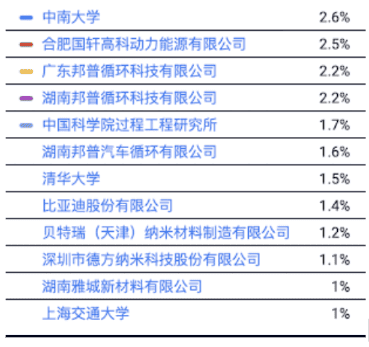

Suppose a company wants to design and manufacture LFP in North America. In that case, they first have to work around the 100,000 US implementation patents on LFP, most of which are owned by Chinese companies. In addition, it still takes 10+ years to go from lab samples to shipments in a North American car.

1% or greater US patent owners for LFP

Perception #4: NMC Has Massive ESG Issues

Environmental, social, and governance (ESG) considerations often favor LFP due to concerns surrounding land-based mining, notably nickel and cobalt extraction. Instances of deforestation, toxic waste generation, and human rights violations in mining regions like Indonesia and Africa spotlight the need for more sustainable practices. Most of these mines are owned and operated by Chinese companies with questionable human and environmental practices.

However, next-generation technologies in deep-sea mining present a sustainable alternative, mitigating human rights and environmental issues associated with land-based mining. E.g., Impossible Metals selective harvesting technology.

Perception #5: Consumers Have No Compromises with LFP

Contrary to the belief that LFP comes without compromises, LFP’s constant voltage curve presents challenges like inaccurate charge estimation, affecting range predictions—a critical consumer factor. Additionally, cold weather impacts LFP’s efficiency, demanding substantial energy for battery conditioning, further reducing range. These factors need consideration, especially for regions with colder climates and heightened consumer expectations.

Looking Ahead: Navigating the Landscape

In a market today dominated by nickel-rich chemistries, the landscape is evolving with the emergence of deep-sea mining technologies. The prospect of securing ample nickel and cobalt from the ocean floor to electrify every form of transportation for the next 100 years promises to redefine cost structures, sustainability, and societal impact. While LFP retains its place in the diverse array of battery chemistries, the narrative of its absolute dominance may require reconsideration. Impossible Metals’ strategy is to sell it selectively harvest nickel and cobalt at a discount to enable its customers to deliver NMC cars at a lower cost than LFP, enabling everyone to afford battery electric vehicles.

———————————

Watch the webinar recently held on this topic on our YouTube channel.