On August 4, 2021, President Biden signed an Executive Order to make half of all new vehicles sold in 2030 zero-emissions vehicles, or electric vehicles (EVs). And on February 14, 2023, the European Parliament approved a regulation for vehicle manufacturers that includes a 55% target to cut CO2 emissions from cars by 2030 to encourage the production of zero- and low-emission vehicles.

Replacing conventional vehicles with EVs is a critical component to limit global warming to well below 2 degrees Celsius, and preferably to 1.5 degrees Celsius by reducing CO2 emissions.

As a result of these green policy regulations, demand for lithium-ion batteries is growing at a greater than 28% compound annual growth rate (CAGR), driven by the growing demand for EVs. The majority of EV batteries use cathodes with nickel and cobalt in chemistry called NMC (nickel manganese cobalt) or NCA (nickel cobalt aluminum). A cathode called LFP that uses iron and phosphorus instead of nickel or cobalt is gaining traction with many automobile manufacturers.

The perceived risk of sourcing nickel and cobalt in addition to the expected costs of these materials is driving automobile manufacturers to contemplate a move to LFP in the 2026+ timeframe when supply volume from new manufacturing may become mature.

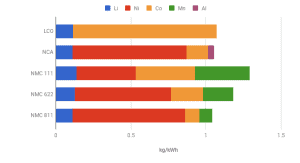

Comparison of different battery chemistries – LCO, NCA, and NMC – and their material/elemental composition (Fu et al., Lithium-Ion Battery Supply Chain Considerations: Analysis of Potential Bottlenecks in Critical Metals (DOI: 10.1016/j.joule.2017.08.019)

But are these manufacturers looking at the entire picture? We don’t think so, and here’s why.

LFP-Based Cathode Weaknesses

LFP-based cathodes have a number of weaknesses, including:

- Approximately 33% lower vehicle driving range than Nickel-based batteries due to lower energy density

- Shorter range in cold temperatures

- Reduced accuracy when calculating battery range

- Low recycle value

- Scarcity – like nickel and cobalt used in NMC batteries, iron and phosphorous are used in many commodities including steel making, communication and logistics, and the projected demand for these minerals is high

What is the True Cost of Iron (LFP) vs Nickel (NCM) Batteries?

Typically the cathode makes up 40% of the cost of a LFP battery and 59% of the cost of a NMC811 battery.

At first glance, LFP batteries are approximately $12 per kWh cheaper than NMC batteries. However, this price difference doesn’t take into account the value of recycling the used battery at the end of its life. Iron and phosphorus from LFP batteries are not cost-effective to recycle, making the lithium also not cost-effective to recover. On the other hand, the nickel and cobalt in an NMC battery are valuable and easily recycled. In fact, 60% of nickel and 32% of cobalt are already recycled today. Each used NMC811 battery contains approximately $30 per kWh of nickel and cobalt. When the recycle value of end-of-life cells is accounted for in the cost of NMC/NCA, it is less expensive than LFP.

Here’s How We Can Address the Challenges of the Battery Metals Supply

Deep seabed minerals could significantly increase the supply of battery metals including nickel, cobalt, copper, and manganese. To date 24 exploration licenses have been issued for harvesting the deep seabed minerals contained in polymetallic nodules. 24 exploration permits have been issued:

- 19 exploration permits by the International Seabed Authority (ISA)

- 3 exploration permits by the Cooks Islands Seabed Minerals Authority (SBMA)

- 2 exploration permits by the US National Oceanic and Atmospheric Administration (NOAA)

Approximately a dozen companies are working on technology to harvest seabed minerals.

The majority of seabed minerals companies are developing dredge-based technology which is expected to generate large sediment plumes; destroying the habitat and biodiversity in the mining area. As a result, there is significant concern from environmental groups and civil society about the impacts of seabed mining on the ocean environment.

Impossible Metals is developing an approach to metals harvesting and processing that will have significantly lower social and environmental impacts and risks. We are developing autonomous underwater vehicles to selectively pick up nodules and avoid destroying the seabed habitat and its biodiversity.

Moving Forward with Supply Chain Considerations

Two key issues should be included in the supply chain considerations as vehicle manufacturers move toward full electrification:

- The recycling value of all battery chemistries should be considered in life-cycle cost analyses; and

- The potential for the inclusion of sustainably and responsibly sourced seabed minerals in the EV supply chain should be considered, especially if the environmental, social, and governance (ESG) impacts may be less than the current terrestrial sources of these metals.